I was lucky to have a father who helped me understand money and how financial markets worked really early on. I remember conversations with him about the velocity of money and about how the money supply grew to keep track of the growing economy. He helped me invest into my first privatisation (South Africa’s Iron and Steel Corporation) and both parents helped me grow up with a long time preference for assets.

I often think of him and the conversations we’d have over bitcoin if he were still around. I’d like to ask him if I’m in a cult? There’s an in-group and and out-group. And some pretty strong beliefs involved: I mean, one group believes that this will change the world, the other believes it’s all a giant Ponzi scheme.

Then there’s the question as to whether a deflationary currency can work with human nature? Will people be out of the streets protesting at their Bitcoin salary being reduced year on year (assuming growing bitcoin-ification)? Do we know how this will play out?

And mostly I’d just like to talk to him about the economy and how he sees things playing out? I feel like the next few years will more of a great reset rather than the soft landing promised to us by economic planners at central banks.

I’d like to talk to him about the game theory of adoption and how that will speed up? So far we just have MicroStrategy, Texas & Wyoming, and El Salvador clued into the early adoption maxim. What happens when other companies, states and countries jump on board? Things will start getting bumpy. Maybe that’s just the nature of successful things: they polarise. You either love the Cybertruck or hate it. In the early 2000s you loved Linux or it was, to [mis]quote Steve Balmer, “an intellectual property cancer”. So maybe the cult isn’t so much of a cult and the in-group/out-group dynamic at play.

New technologies tend to reshape the competitive landscape by giving underdogs the chance to leapfrog incumbents. I wonder how this will play out at the sovereign level? Which central bank will be the first to announce serious levels of bitcoin custody and what will the conversations be at the BIS (Bank of International Settlements) when this comes out. Probably something also the lines of “bad country” and privately “we need our Bitcoin custody strategy in place ASAP”.

This does speak to building good tooling for Bitcoin custody. I’d imagine the likes of the Bank of England or the Fed want more than a Coinbase custody account. Outside of exchanges building their own tooling for custody, and the amazing setup of Acinq and how they use the AWS Nitro Enclave product.

For a central bank to really hold Bitcoin on their balance sheet they will need

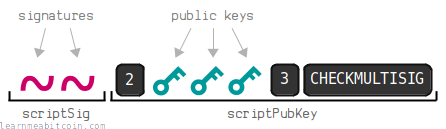

- a trusted group of multi-sig signatories

- a group coordinator that issues signing devices, handles firmware upgrades, cycles out old signatories and onboards new candidates

- transaction preparation software (PSBTcreation, sending, gathering, broadcasting to mempool)

- transaction logging software

- UTXO management software

- audit and proof-of-reserves software

This is me predicting that we’ll see the introduction of some interesting large-scale custody solutions in the next year. It would certainly be an interesting business to build the tooling for this.

cool, keep on blog writing, Greetings Georg , former Allianz you know 🙂