I spent the last weeks trying to understand the design tradeoffs necessary to build the “perfect” Bitcoin miner. “Perfect” being defined as: air-cooled, comparable mining efficiency (J/TH), and built with an eye towards future direct-to-chip water cooling.

I’ve broken this down into 5 parts:

- The State of Bitcoin Mining

- Mining Industry Trends

- Product Definition

- Product Development

- Marketing and Distribution

Comments are marked:

- Strong opinion, loosely held: for topics I am happy to be persuaded otherwise on

- Strong opinion, strongly held: for topics where my personal experience points me to a particular opinion.

- Loose opinion, loosely held: where I’m lacking data points.

Part 1: The State of Bitcoin Mining

My first experience with Bitcoin mining was toggling the Bitcoin-Qt “mine” option and hearing the CPU fan maxing out.

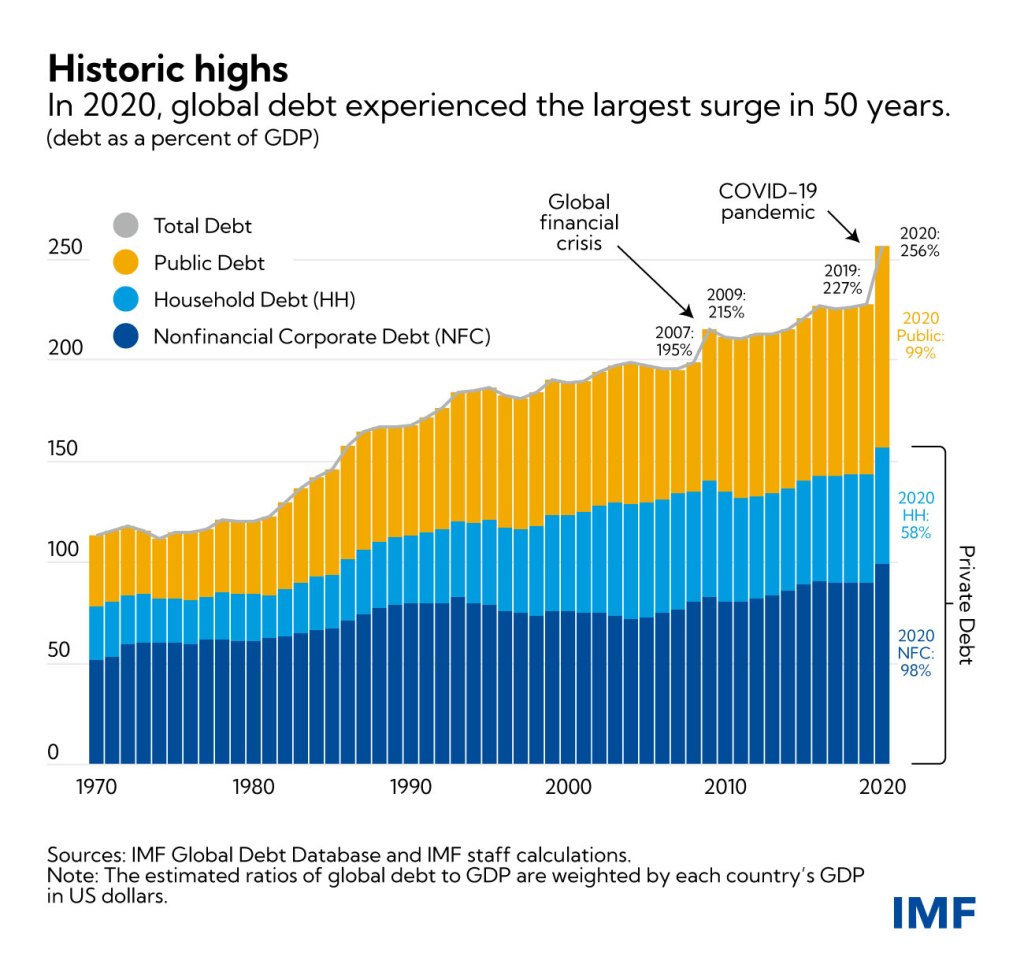

Many years later, Bitcoin mining is a huge industry but also very niche, dominated by those with access to cheap capital and a nose for competitive power agreements. Bitcoin mining is THE large flexible load so beloved by grid operators and projected to use 10% of the Texas power output in 2025!

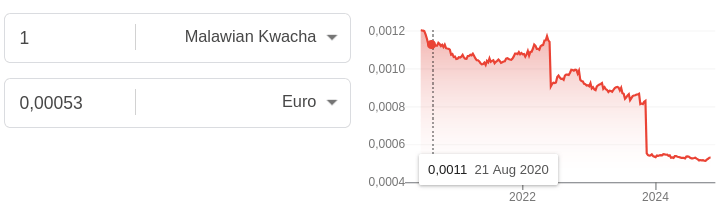

Today mining provides low-grade heat for industrial processes, is THE buyer of last resort for excess energy, monetises stranded energy, and enables hydropower construction for remote Malawian villages. Above all, Bitcoin mining bakes fresh Bitcoin transactions into the immutable blockchain ledger.

(Strong opinion, strongly held): Mining today: the bad

- The mining industry is dominated by one company presenting a huge geopolitical risk.

- Mining hardware (by my estimate 3.5 million machines) is unreliable.

- Control software is so unreliable that people install third-party alternatives!

- The ecosystem is as disjointed as the early PC industry where people were cobbling together systems from multiple vendors (e.g. swapping out control boards) and control software (all very ad hoc)

To better understand the mining industry, I’ve spent extensive time following mining pool and mining firmware support chats.

There were many classes of problems that would just go away with someone being responsible for end-to-end design.

What I saw in the support forums surprised me:

- users asking “which fan is fan0?” repeatedly.

- endless requests for debug logs to be downloaded, zipped, and DM’d (why is this not automated?).

- users getting advice on hand soldering replacement ASICs onto their hash boards

- users struggling with command line options to restore firmware

- a system being ruined due to a design that permitted cooling loops misconfiguration (feeding in hot water to the cold port).

It sounds like a broken industry, but I’m excited: it’s so ripe for disruption. Bitcoin mining still hasn’t experienced the Michael Dell sales process innovation, or the It just works feeling of Apple hardware or the product-wide command-line unification of Cisco’s IOS.

Mining problem summary

- Supply chain geopolitical risks (Bitmain + CCP)

- Unreliable hardware / stability issues / lower than expected hashing

- Unreliable software and a hardware mismatch: shipped software is replaced with third party software, is then hooked into third party MMS software (to control more than a few miners, operators need to invest in mining management software e.g. Foreman). More moving parts from different vendors can quickly become a blame game when things don’t work.

- Both manufacturer and third party software options are closed source: the lack of transparency makes it difficult to audit for malicious code or vulnerabilities

- Mining rigs are an odd form factor: the current mining form factor means a retooling/rethinking of the standardised data-centre racking, power & data delivery and hot/cold aisle isolation.

- The Mining sales process sells individual miners rather than a system.

Part 2: Mining Industry Trends

To build the PerfectMiner™ I would like to understand the macro trends influencing Bitcoin mining.

Mining moves closer to the grid operator

Grid operators love large variable loads. Spinning up a gas turbine takes time. It’s easier to have a grid load that can be curtailed when needed. At the same time, grid operators need to manage renewable energy curtailment by creating additional monetizable consumers of the excess capacity.

The rise of behind-the-meter mining

Behind the meter mining is driven by two factors:

- utilities penalising producers with negative pricing. (especially solar during the predictable midday peak).

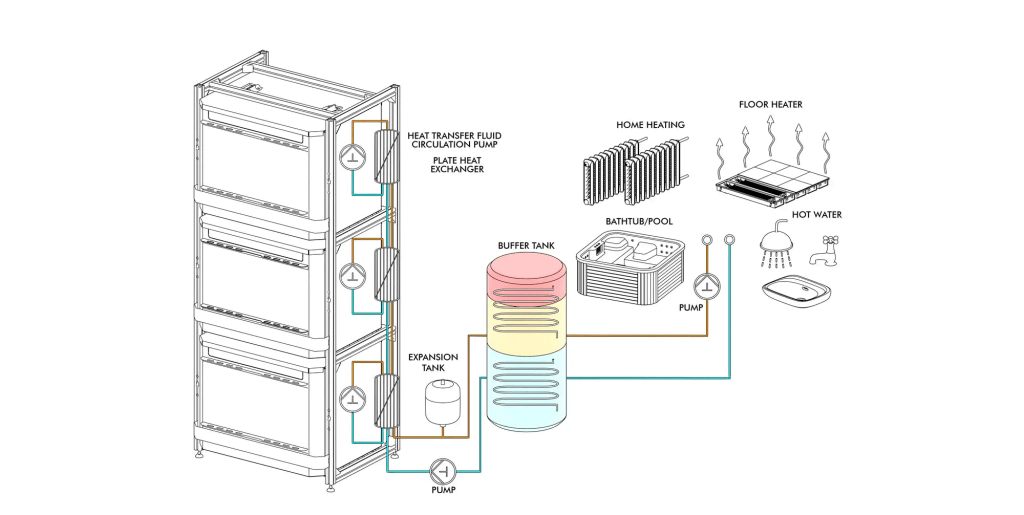

- Solar panel prices falling more quickly than battery prices meaning users are looking at alternative options like thermal batteries (heat water in a buffer tank) or heating with a Bitcoin miner.

On a larger scale, companies like Gridless Compute are constructing facilities in regions without an existing grid.

It’s not just behind the [consumer] meter though. In my talks with the CEO of Agile Energy X, Tepco (Japanese Utility) is using behind the [utility] meter mining to monetise excess renewable energy.

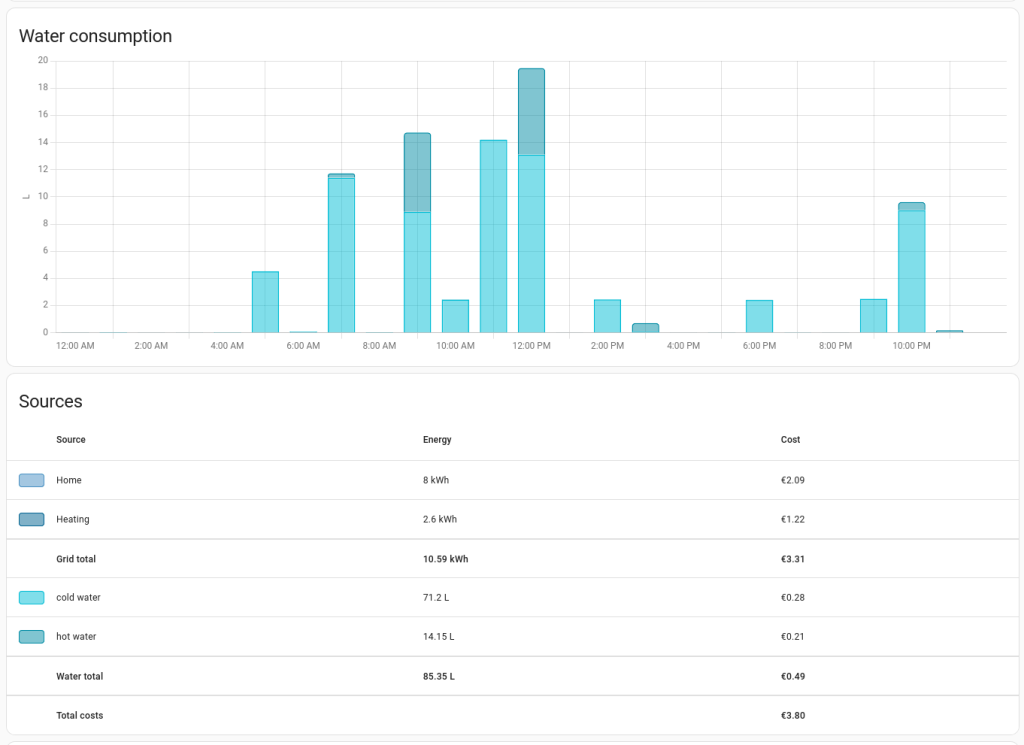

The rise of IoT and home automation standards

Home automation systems enable the tying together of different systems. Heating could come from a heat pump and Bitcoin miner, depending on outside temperature and energy prices.

- The process of integrating auxiliary heat sources becomes easier. For example, newer heat pumps include an API, and Home automation systems like Home Assistant are known for quickly supporting new systems enabling “Waste” heat from Bitcoin mining can now more easily be integrated into an overall heating plan.

- HVAC manufacturers such as Viessmann, Carrier, Johnson Controls, Daikin, and Bosch are transitioning from traditional boiler production to becoming software-centric companies. They are increasingly open to integrating alternative heat sources like waste heat from Bitcoin miners.

Advancements in Hardware and Cooling Technologies

Increasing power densities mean the only viable way to remove heat is using D2C cooling. This is now the case in new AI buildouts. We’re quickly nearing the point where it’s impossible to blow enough air over heatsinks.

For reference, I calculated the airflow to keep an ASIC below 80 degrees C. This requires substantial aluminum surface area or significant airflow, which may not be practical.

Significant advances in D2C water cooling standardisation from ASHRAE (American Society of Heating, Refrigerating, and Air-Conditioning Engineers) mean there are existing standards to benefit from.

Part 3: Product Definition

Selling a Solution Instead of Hardware

(strong opinion, strongly held): Current Bitcoin mining rigs are sold based on a single factor: hash rate.

A better approach is to sell a solution: The solution helps the miner plan their rollout, model their CAPEX, order, deploy, access and manage their mining farm.

Compare Ubiquiti of 5 years ago selling individual Wi-Fi access points to the Ubiquiti of today. Their current product helps you plan, purchase and manage your network (their UniFi system). It’s almost incidental that they also sell you the equipment.

- Ubiquiti sells more devices as a result.

- They also have more customers because they offer a solution that provides the peace of mind from knowing that everything will work together and be correctly specified.

- Users like the ease and are steered towards buying replacement devices that “just work” with their existing system.

- Ubiquiti proves there is no marketing better than word of mouth (Ubiquiti has one of the highest NPS (Net Promoter Score) ratings).

The Importance of Early Planning

(Strong opinion, loosely held) A miner knows their inputs: their power purchasing price and available capital. They also know their power configuration (delta/wye, single phase, three-phase, 208v vs 400v etc). But each miner has to develop their own modeling tools to help understand the potential return of a new site. This means the sales process should start 6-12 months before the systems are operational with a potential customer virtually building their system and modeling future returns. The sales tooling could even run the risk analysis based on different Bitcoin pricing outcomes or backtest against historical weather events, network hash rate changes… the list is endless. But the point is to help the potential customer early in their journey.

Part of this early modeling would be helping the customer:

It might be that the perfect Bitcoin miner doesn’t do all these things in-house, instead partnering with experts, but the important part is that the customer journey is simplified from creating spreadsheet scenarios, perusing spec sheets etc., to just a single web login, order form, and the right devices show up.

PerfectMiner™ as a System

(strong opinion, strongly held) In trying to understand the mining industry, I reached out to a range of mining operators. I realise that they are very strong on operational issues, less strong on technical ones. And that’s fine! Someone running a mining farm shouldn’t need to install MMS like Foreman to run their fleet, or set up VPNs to remotely login in to their mining operation, or worry about collecting rig metrics in a time-series database.

And yet all current solutions require this.

The PerfectMiner™ would be a cloud-managed account where it’s easy to ingest a new machine, perhaps by scanning a barcode after a reset button is pressed. The individual mining rig would then:

- Pull the latest firmware (something like an A/B boot partition with A being the factory firmware and B being the current firmware thus enabling resets to a known safe state).

- Connect back to the cloud hosted control software (assume that good internet access is provided for the mining process)

- Pull the predefined power profile (should it mine at 100% or use an alternative policy?).

- Download the mining pool login and connection configuration.

- Run any ASIC autotuning

- Provide visual feedback to the operator that it’s ingested and working

- Begin mining and serving up operational metrics to the cloud service

Integration with Power Producers

(weak opinion, loosely held) If we extend the idea outwards: the perfect mining rig is actually a system of miners and that system is part of the greater electrical grid system. Presently grid operators are completely turning off miners (and the associated thermal stress). What if the grid operator could send a curtailment signal that would drop miners down to a lower power mode?

The PerfectMiner™ system could integrate nicely with grid operator software as part of a power-delivery/power-curtailment supply agreement.

PerfectMiner™ should support existing aggregator platforms and direct communication APIs/OpenADR (Open Automated Demand Response).

Emphasis on Metrics and Observability

(strong opinion, strongly held): If there’s one thing I learned from running SoundCloud’s production engineering environment, it’s that good system observability goes a long way in debugging problems. This metrics backend could leverage much of the Prometheus open source monitoring system which then lets you use PromQL to expose metrics in an interesting way:

Some examples off the top of my head:

Identify Miners with Low Hash Rates: detects miners whose hash rates are less than 90% of the average over the last 5 minutes.

mining_hash_rate{job="Bitcoin-miner"} < (avg_over_time(mining_hash_rate[5m]) * 0.9)

Identify Miners with Unusual Power Consumption: Flags miners with a power efficiency worse than 110% of the fleet average.

(monitoring_power_consumption_watts{job="Bitcoin-miner"} / mining_hash_rate{job="Bitcoin-miner"}) > (avg by (job) (monitoring_power_consumption_watts / mining_hash_rate) * 1.1)

Check Network Latency Issues: Lists miners experiencing network latency over 100 milliseconds.

mining_network_latency_seconds{job="Bitcoin-miner"} > 0.1

Locate Miners with High Reject Rates: Lists rigs with great than 5% rejection

(rate(mining_rejected_shares_total[5m]) / rate(mining_accepted_shares_total[5m]) ) > 0.05

Metrics around heat are particularly important too. Maintaining them for at least 1.5 years would give visibility into seasonal heat challenges. Good seasonal data can also help model future performance thresholds (can’t always assume max hashing).

Great metrics feed into great alerting. The PerfectMiner™ system could alert ahead of heat peaks or when a threshold of ASICs fail on a machine. The perfect mining solution would then integrate with the onboard LED to help discover the miner in rows of machines.

Improved Form Factor and Hardware Design

(weak opinion, loosely held): I’ve tried to understand the history behind the distinctive form factor of mining systems. I understand that it’s grown out of a desire to focus on cooling efficiency and the simple design reduces material costs. I’d argue that, as power densities increase, there will be a renewed focus on water cooling and indeed for tighter hot/cold aisle separation. These are all problems well solved in the traditional data center 19” rack. While the PerfectMiner™ may want to appeal to existing mining operations, longer term, it makes sense to rethink the form factor.

These are the guiding principles I’d use for this:

- Make it nice for the customer with front-facing ports (network, power, USB/serial) should be easily accessible without entering the hot aisle.

- A huge, bright Identification LED to help technicians find the right miner in a large room.

- Airflow considerations suggest that larger fan sizes are more efficient. The largest standard computer fan is 200mm, and two of these can fit side-by-side in a 19-inch rack (482mm), leaving sufficient space for power, network connections, reset buttons, and identification LEDs. This configuration results in a box height of approximately 5U (222mm). While this design may increase material costs, the total cost of ownership (TCO) could be lower. The non-standard shapes of current miners often require custom hot-cold aisle shrouds and shelving. In contrast, larger fans not only reduce the need for custom infrastructure but also consume significantly less power for the same cubic feet per minute (CFM) of airflow. Additionally, with a sufficiently large fan, the mining rig might only need a front (pushing) fan instead of the current push-pull fan design, effectively halving the number of fans and simplifying maintenance by eliminating the need to access the hot aisle for replacements.

- Easily replaceable hash boards: The PerfectMiner™ would have hash boards that can easily be replaced. Perhaps the aluminium heatsink is also providing structural rigidity. The sliding in/out could even be based off a PCB edge connector that makes contact with a power pickup within the chassis. Important would be ensuring that the ground pin engages before the supply voltage is engaged (perhaps longer than other pins?).

- “The PerfectMiner™ incorporates boards that accommodate failing ASICs.” (I’m not sure how a SPI bus would route past failed ASICs but presume there’s a good way without running individual traces for each ASIC). The idea follows Google’s data center principle of only replacing equipment when a rack reaches a defined level of brokenness; the remote hands tech would then batch replace boards with >n failed ASICs.

Power Planning for Alternative Form Factors

(strong opinion, weakly held)

- Datacenter racks (at least in SoundCloud DC): Top of rack delivery: 40 kW / 3.5kW per miner = about 11 units per rack

- 41U rack / 5U per miner = 8 miners per rack.

- 8 miners @ 3.5kW = 28kW power draw

- Investigate future datacenter balancing AI DC with miner power. I.Ee, the Datacenter agreement lets them pull n KW that can then be primarily allocated to AI compute during peak, secondarily allocated to Bitcoin compute during AI downtime.

Part 4: Product Development

Embracing Super-Fans in Product Development

Strong opinion, loosely held: I’ve built a few products in my time and the most exciting moment is when the super fans start contributing. These are the early adopters, and deeply invested into the success of the product. Not only do they want the product to be the very best, but they are also great word-of-mouth marketing sources..

Super-fans help move the product from theoretical features and engineering decisions to actual use case reality. They form the backbone of the early ecosystem and so it’s really important to listen to their feedback. For example around 2006 Nvidia noticed that a passionate community of developers (essentially their superfans) were using GPU shaders for general purpose compute. This led them to work with that community and create CUDA and well the rest is history.

I mention this because the PerfectMiner™ would greatly benefit from collaborative development with super-fans. That’s not so suggest that it’s possible to outsource the hard work. It is to suggest a blurred line between in-house and outside developers (also great for hiring talent).

Principles for Community Adoption

(Strong opinion, strongly held) In the past here are some of the principles that I used to get community adoption:

- Seed hardware: When I was developing Buddycloud, I noticed an open source contributor doing great app work but he was unable to afford real Apple hardware for testing. I ensured he had a test iPhone. In the PerfectMiner™ case, this would be seeding individual ASICs, and hash boards to enthusiasts or sending them hashing and control boards.

- Open source as much as possible: While I’m very aware that open sourcing doesn’t magically get others to help with the work, it does create a sense of trust and attract a particular type of developer and leads to a good hiring funnel too.

- Get ASICs listed as standard components in JLPCB and PCBWay: Anyone who has hand soldered Bitmain’s BM3070 ASICs (never again!) onto a custom mining board would much rather have them in the catalogue and order a board with ASICs pre-assembled.

- Sponsor working together: Something else that worked well for me in the Buddycloud days was remote hack days: getting everyone out of their usual environment with a nice incentive. In this case it was a mountain chalet for a week, good internet, nice nearby hikes and great food. I was able to help with flight costs for some developers in Brazil that were doing great work. Much hacking happened there and the bonds formed during that time contributed to a great working environment afterwards.

- Show commitment to decentralisation: Stratum v2 and Datum both move the mining pool influence over block template assembly. Early support of these protocols speaks volumes about the company’s values (and would help attract developers).

- Champion standardisation: There’s no standard for replaceable hash-boards, or replaceable PSUs or control boards or case sizes. There’s a huge market gap for sticking a stake in the ground and being the champion of modular mining equipment. PerfectMiner™ can be the reference standard.

Embracing Imperfection for Speed

As a perfectionist, I find it challenging to embrace messiness, but disregarding perfection is essential for speed. While engineers often strive for a perfect product at launch, there is a strong business need to initiate the feedback cycle as quickly as possible. To achieve the vision for the PerfectMiner™, I would adopt a development approach that is both fast and open.

Current mining hardware is developed in secret and thrown over the wall in a take it or leave it manner.

My approach would be to embrace imperfection as much as possible. Shipping a product is a new git commit (sure there will be tagged releases for clarity), but more than ever, PerfectMiner™ should be built on many small (uncomfortably imperfect git commits) and reverts where necessary.

To really show that PerfectMiner™ is something different I’d push to show off the development process as much as possible.

- Be loud and clear about design tradeoffs

- Be ok with saying “we don’t know and here’s how we will find out”

- Show and broadcast internal meetings about building the control software

- Build in an openness metric “What have we shared with the wider community this week?”

- Onsite with future customers as much as possible: ERCOT, National Grid, Riot, Marathon should be considered as coworking spaces.

- Keep aiming for Scrappiness: Perfection grows from scrappiness. And emphasising scrappiness can help counteract the safety of building on the back of existing business revenues.

Phased Introduction of PerfectMiner™

(weak opinion, weakly held) I’d focus on the following product milestones as a way to coordinate with marketing.

Phase 1: Basic working prototype

- Control board software

- Working Hashboard: ASIC bring-up

- Integration with heat sink + cooling

- What’s being sold? Community involvement in open development

- How is it being sold? No Sales, instead building up sales pipeline for MVP

Phase 2: (MVP): working rig

- Case scale up

- Cooling + fan options

- Larger PCBs

- What’s being sold?

- “A future where you want to be involved”

- “I look forward to working on the infrastructure”

- How is it being sold?

- Using outreach from Basic Working Version

Phase 3: Miner + MMS

- Manage a fleet of miners

- Ingest with a mobile app

- What’s being sold

- I can ingest new machines into my MMS – “It just works”

- I see metrics that matter (how much I mined), I get alerts for issues

- How is it being sold?

- Traditional sales.

Phase 4: Miner D2C Water cooling + low grade heat options

- Match HVAC upgrade cycles with silicon iterations

- Be seen as an innovator

- Reduce risk: define a standard / certification (American Society of Heating, Refrigerating, and Air-Conditioning Engineers ASHRAE standard)

- Cost savings (EG COP for a heat pump = 3.5 vs mining return)

Part 5: Marketing & Distribution

Marketing Challenges and Objectives

So PerfectMiner™ is awesome, how to tell the world about it?

It’s fresh. It’s highly differentiated: open hardware, open OS and a strong community. But how to get it into the hands of the Riots or Marathons or the mining world or the HVAC builders or solar battery builders or grid operators?

These groups care less about “open” and more about reliability and ROI.

But there is an overlap with “open” developers and with potential early adoption customers of a PerfectMiner™ they both belong to the branding archetype of

- Explorer type (freedom)

- Outlaw type (liberation)

Loose opinion, loosely held: The value Proposition of “I am xxx so you can yyy (rational benefit) and feel zzz (emotional benefit)” becomes:

- I’m a solar installer, needing to monetise excess capacity around noon and using PerfectMiner™ appeals to my early adopter need”

- I’m a grid operator, seeking a more reliable hardware path and PerfectMiner’s openness appeals to my sense of freedom”

PerfectMiner™ Value Proposition

The value proposition should resonate with both the rational and emotional needs of customers.

- Rational Benefits:

- Efficiency and Reliability: High-performance mining rigs with robust uptime.

- Ease of Integration: Seamless integration with existing systems and grid infrastructure.

- Advanced Metrics and Management: Superior monitoring and control capabilities.

- Cost Savings: Reduced total cost of ownership through modular design and energy efficiency.

- Emotional Benefits:

- Empowerment: Providing control through open-source solutions.

- Innovation: Being part of the next generation of mining technology.

- Community: Joining a collaborative and supportive network.

Marketing Strategy

Marketing efforts should align closely with the customer journey stages:

- Awareness

- Objective: Introduce PerfectMiner™ to potential customers.

- Actions:

- Hackathons, Bitcoin conferences, Energy conferences

- Engage in social media campaigns targeting mining communities and energy sectors.

- Collaborate with Open Source Miners United group

- Consideration

- Objective: Provide detailed information to interested prospects.

- Actions:

- Comprehensive documentation, specifications, and case studies.

- Sample units or demos to showcase product capabilities.

- Host Q&A sessions with engineering and product teams.

- Purchase

- Objective: Facilitate a smooth purchasing process.

- Actions:

- Simplify ordering through an intuitive online platform.

- Provide price/return modelling software to help guide the sales process

- Onboarding

- Objective: Ensure successful deployment and integration.

- Actions:

- Offer step-by-step guides and video tutorials.

- Provide dedicated support and Discuss forums (prefer Forums over chat so that recurring problems can be identified)

- Retention (Honeymooning and Saturation)

- Objective: Maintain customer satisfaction

- Actions:

- Regularly update software.

- Foster community involvement through forums (perhaps hack days alongside Bitcoin/Energy conferences)

- Offboarding

- Objective: Handle end-of-life or upgrades smoothly.

- Actions:

- Provide trade-in or hashboard upgrade programs

TL;DR Summary

The theoretical PerfectMiner™ is a difficult product to build and ship. But risks can be reduced through a collaborative community-involved development process that emphasises rapid shipping of reference designs and rapid hardware and software updates. Differentiation should focus on open development and superior management software.

A final product should integrate with existing waste heat recapture systems.